Fascination About Offshore Company Formation

Table of ContentsRumored Buzz on Offshore Company FormationTop Guidelines Of Offshore Company FormationUnknown Facts About Offshore Company FormationThe Definitive Guide to Offshore Company Formation

Hong Kong enables creation of offshore firms and also overseas bank accounts if your business does not sell Hong Kong territory. In this case, there will certainly be no company tax used on your profits. Offshore business in Hong Kong are appealing: stable jurisdiction with superb track record and also a reliable overseas banking system.

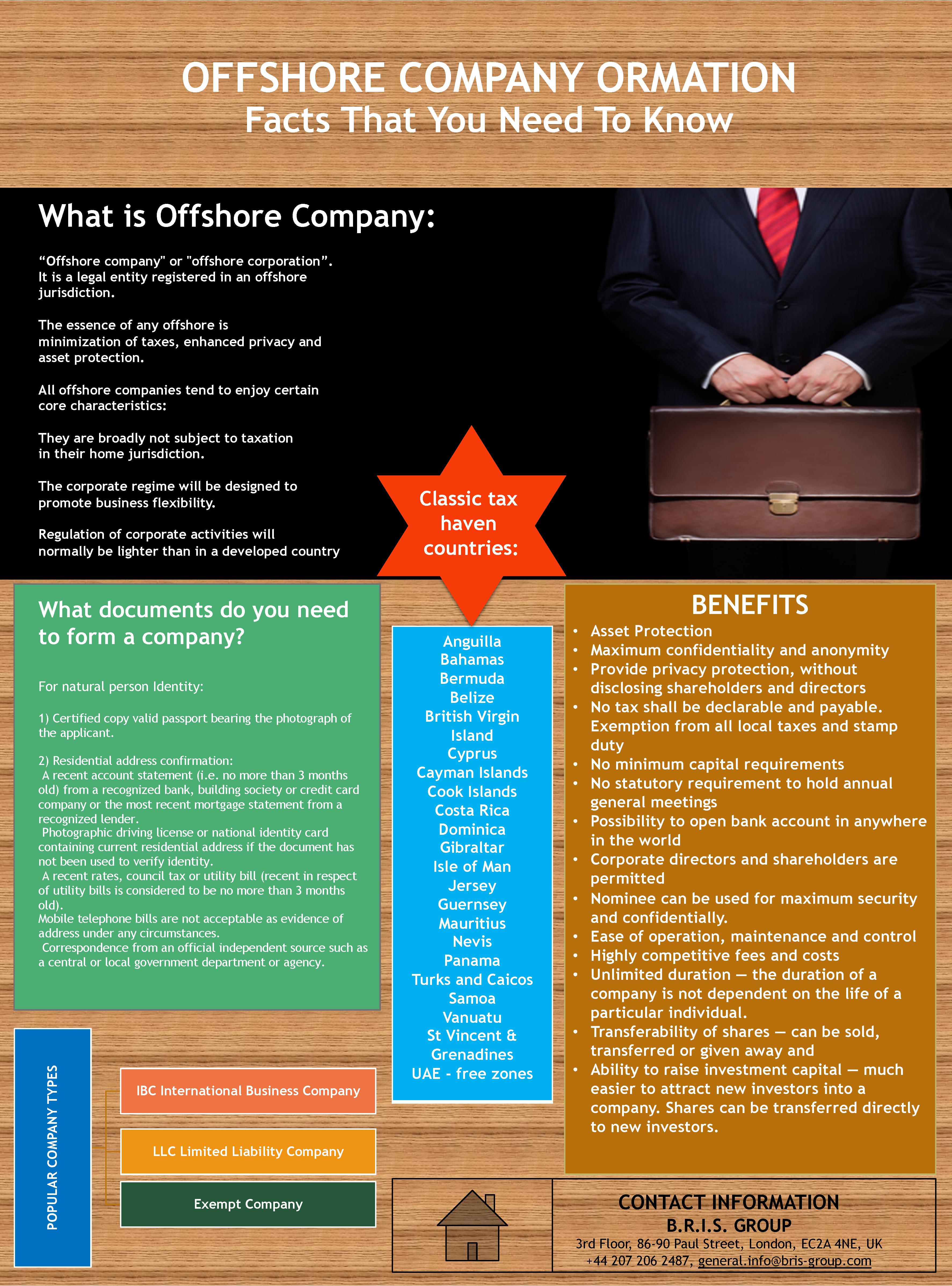

There are no clear distinctions due to the specific company regulations of each country, typically the major differences are tax obligation structure, the degree of privacy and property defense. Numerous nations wish to bring in foreign firms and also capitalists by introducing tax legislations pleasant to non-residents and global business. Delaware in the United States as an example is historically among the greatest tax obligation havens on the planet.

Offshore tax obligation sanctuaries are commonly classified as a method for tax obligation evasion. This is frequently as a result of their strict privacy and also property defense legislations as they are not obliged to report or disclose any details to your country of residence. That does not imply you do not have to adhere to legislations where you are resident in terms of financial reporting obligations.

The 8-Second Trick For Offshore Company Formation

The term offshore refers to the business not being resident where it is officially included. Moreover, frequently much more than not, the directors and various other participants of an overseas business are non-resident additionally contributing to the company not being resident in the nation of enrollment. The term "overseas" may be a little bit complex, because a number of modern-day financial centres in Europe, such as Luxembourg, Cyprus and also Malta use worldwide company entities the exact same benefits to non-resident firms as the traditional Caribbean "tax sanctuaries", however typically do not make use of the term offshore.

Nonetheless, that does not mean you do not need to adhere to legislations where you are resident in regards to financial coverage obligations. The confidentiality by having an offshore firm is not useful source concerning concealing possessions from the government, yet concerning personal privacy as well as security from baseless lawsuits, hazards, partners and other lawful disagreements.

The term offshore and complication surrounding such companies are frequently connected with outrages. However, overseas firms imitate any normal company however are kept in different territories for tax obligation functions hence giving it benefits. This does not indicate it acts illegal, it's merely a means to optimize a company for tax obligation and also security purposes.

Rumored Buzz on Offshore Company Formation

These are typically restrictive requirements, high expenses as well as disclosure policies. Although anybody can begin a firm, not every can get the very same benefits. The most typical advantages you will certainly find are: Easy of enrollment, Marginal costs, pop over here Versatile management and also very little reporting requirements, No forex constraints, Good regional corporate regulations, High privacy, Tax obligation benefits, Minimal or no restrictions in concerns to organization tasks, Moving opportunities Although it truly depends upon the regulations of your country of residence and also how you wish to optimize your service, generally online businesses and anything that is not depending on physical facilities commonly has the greatest advantages.

Activities such as the below are one website link of the most usual as well as useful for offshore enrollment: Offshore savings and investments Foreign exchange and also supply trading, Shopping Professional solution firm Net solutions International based business, Digital-based Company, Global trading Possession of intellectual building Your country of residence will eventually specify if you can end up being completely tax-free or otherwise (offshore company formation).

This list is not exhaustive and also does not always use to all territories, these are typically sent out off to the registration workplace where you desire to sign up the company.

is an enterprise which only executes financial activities outside the country in which it is signed up. An overseas company can be any business which doesn't run "at residence". At the very same time, according to popular opinion, an overseas business is any venture which enjoys in the nation of registration (offshore company formation).

Some Known Details About Offshore Company Formation

Setting up an offshore firm appears challenging, yet it worth the effort. An usual reason to establish up an overseas company is to fulfill the lawful needs of the country where you want to buy residential or commercial property.

Due to the fact that discretion is just one of one of the most important aspects of our work, all details gotten in on this form will be kept purely personal (offshore company formation).

Even prior to going into details on exactly how an overseas firm is created, we initially need to recognize what an overseas company truly is. This is a service entity that is formed as well as operates outdoors your country of residence. The term 'offshore' in finance describes business practices that are located outside the owner's nationwide boundaries.